how much does illinois tax on paychecks

The information provided by the Paycheck Calculator provides general information regarding the calculation of taxes on wages for Illinois residents only. Illinois Salary Paycheck Calculator.

Why Illinois Is In Trouble 109 881 Public Employees With 100 000 Paychecks Cost Taxpayers 14b

However each state specifies its own tax rates which we will.

. If you would like to file your IL-1040 through MyTax Illinois you must file using your My Tax Illinois account. As of 2018 the state income tax rate for Illinois is 495 percent of income after deducting for allowances the employee claims on IL-W-4. No an employer cannot withhold or deduct from wages pending the return of uniforms tools pagers or any other employer owned equipment.

How do I calculate how much tax is taken out of my paycheck. For instance an increase of 100 in your salary will be taxed 3601 hence your net pay will only increase by 6399. When you factor in federal state and local taxes you can figure out your take-home income each paycheck for both salaried and hourly employment with SmartAssets paycheck calculator.

The Illinois bonus tax percent calculator will tell you what your take-home pay will be for your bonus based on the supplemental percentage rate method of withholding. Calculate your Illinois net pay or take home pay by entering your per-period or annual salary along with the pertinent federal state and local W4 information into this free Illinois paycheck calculator. In total Social Security is 124 and Medicare is 29 but the taxes are split evenly between both employee and employer.

The Paycheck Calculator may not account for every tax or fee that applies to you or your employer at any time. Each pay period 62 of your paycheck goes to your share of Social Security taxes and 145 goes to. The Illinois Salary Calculator is a good calculator for calculating your total salary deductions each year this includes Federal Income Tax Rates and Thresholds in 2022 and Illinois State Income Tax Rates and Thresholds in 2022.

Get the latest headlines on Wall Street and international economies money news personal finance the stock market indexes including Dow Jones NASDAQ and more. FedState Employment Taxes Program FSET - a program for employers and payroll companies to electronically file and pay both their Federal and Illinois employment taxes. The first step to calculating payroll in Illinois is applying the state tax rate to each employees earnings.

Payroll tax percentage is 153 of an employees gross taxable wages. Paper reports are for employers with less than 25 employees. Withhold half of the total 765 62 for Social Security plus 145 for Medicare from the employees paycheck.

The income tax system in Illinois emphasizes simplicity. Illinois Taxes Explained in Detail Illinois has a flat income tax of. Also the systems heavy reliance on the federal tax code means you wont need to learn a new set of rules for filing your state return.

According to the Illinois Department of Revenue all incomes are created equal. For the employee above with 1500 in weekly pay the calculation is 1500 x. The states flat rate of 495 means that you dont need any tables to figure out what rate you will be paying.

Employers can find the exact amount to deduct by consulting the tax tables in Booklet IL-700-T. Hours worked from the 1st of the month to the 15th of the month are paid at the end of the month. Personal income tax in Illinois is a flat 495 for 20221.

Can my employer hold my paycheck until I return my uniforms tools pager etc. How much tax is taken out of paycheck in illinois. How much taxes does illinois take out of paycheck Sunday February 27 2022 Edit.

The redemption of US. So how much is the employer cost of payroll taxes. The bonus tax calculator is state-by-state compliant for those states that allow the percent method of calculating withholding on special wage paychecks.

You exceed 12000 in withholding during a quarter it is your responsibility to begin to pay your Illinois withholding income tax semi-weekly in the following quarter the remainder of the year and the subsequent year. For wages and other compensation subtract any exemptions from the wages paid and multiply the result by 495 percent. As of 2018 the state income tax rate for Illinois is 495 percent of income after deducting for allowances the employee claims on IL-W-4.

File Transfer Protocol FTP is for larger employers andor larger multi-account filers. Federal tax rates like income tax Social Security 62 each for both employer and employee and Medicare 145 each plus an additional 09 withheld from the wages of an individual paid more than 200000 are set by the IRS. Payday is the 15th and end of each month.

No Illinois cities charge a local income tax on top of the state income tax though. Generally the rate for withholding Illinois Income Tax is 495 percent. Personal Income Tax in Illinois.

Details of the personal income tax rates used in the 2022 Illinois State Calculator are published below the. The first step to calculating payroll in Illinois is applying the state tax rate to each employees earnings. For more information see Publication 131 Withholding Income Tax Filing and Payment Requirements.

You will then take a tax credit from your nonresident IL state income taxes on your resident IN state income tax return. Although you might be tempted to take an employees earnings and multiply by 495 to come to a withholding amount its not that easy. Withhold half of the total 765 62 for Social Security plus 145 for Medicare from the employees paycheck.

Hourly employees are paid on a semi-monthly basis. Both employers and employees are responsible for payroll taxes. It is not a substitute for the advice of an accountant or other tax professional.

How much is payroll tax in Illinois. Employer payroll tax rates are 62 for Social Security and 145 for Medicare. The option to file Form IL-1040 Illinois Individual Income Tax Return without having a MyTax Illinois account non-login option is no longer available.

Employers are responsible for deducting a flat income tax rate of 495 for all employees. If you do not have an account you may create one by choosing Sign Up in the. For the employee above with 1500 in weekly pay the calculation is 1500 x 765 0765 for a total of 11475.

Youll use your employees IL-W-4 to calculate how much to withhold from their paycheck. Illinois has a flat income tax of 495 which means everyones income in Illinois is taxed at the same rate by the state.

New Tax Law Take Home Pay Calculator For 75 000 Salary

Illinois Paycheck Calculator Smartasset

Salary Paycheck Calculator Calculate Net Income Adp

2022 Federal State Payroll Tax Rates For Employers

What Percentage Of Your Paycheck Goes To Taxes How To Discuss

Paycheck Calculator Take Home Pay Calculator

What You Need To Know About Hiring Workers Calculating A Paycheck

Why Illinois Is In Trouble 109 881 Public Employees With 100 000 Paychecks Cost Taxpayers 14b

Is It Possible For A Weekly Salary Of 500 To Have Over 100 Of Taxes Taken From Each Paycheck Quora

Paycheck Calculator Take Home Pay Calculator

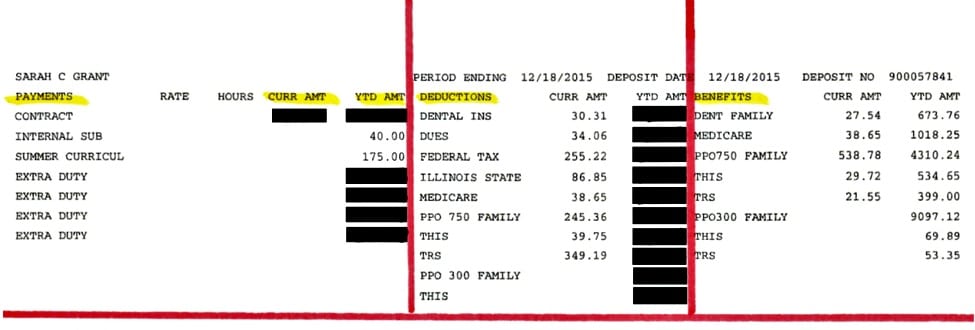

Understanding Your Teacher Paycheck We Are Teachers

Here S How Much Money You Take Home From A 75 000 Salary

Understanding Your Teacher Paycheck We Are Teachers

Why Illinois Is In Trouble 109 881 Public Employees With 100 000 Paychecks Cost Taxpayers 14b

Taxes 5 1 Taxes And Your Paycheck Payroll Taxes Based On Earnings Paid To Government By You And Employer Income Taxes You Pay On Income You Receive Ppt Download

How Much In Taxes Is Taken Out Of Your Paycheck Morningstar

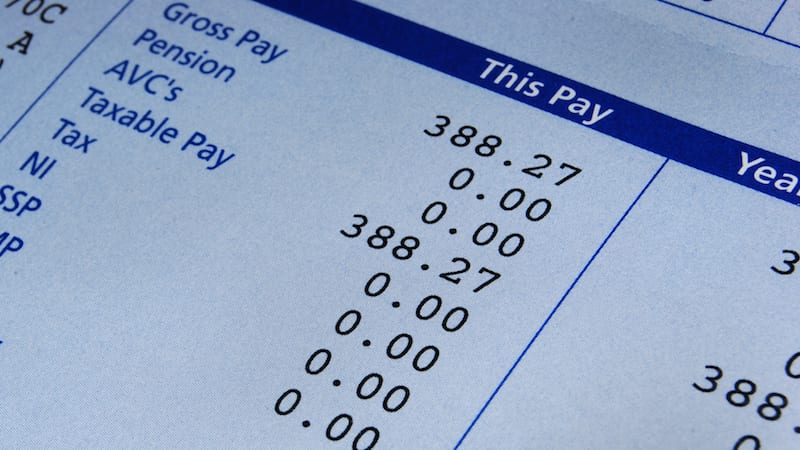

Understanding Your Pay Statement Office Of Human Resources

Free Online Paycheck Calculator Calculate Take Home Pay 2022