what is fsa health care 2022

Get a free demo. Common purchases include everyday health care products like bandages thermometers and glasses.

2022 Limits For Fsa Commuter Benefits And More Announced Wex Inc

The IRS has announced the new health savings account limits for.

. The Navia Benefits Debit MasterCard. Enter Your ZIP Code to Start. Flexible Spending Account FSA An FSA is similar to an HSA but there are a few key differences.

It can allow you to carry over up to 570 per year to use in the following year. What kind of data is available right now for actuaries. Everything from medical expenses that arent covered by a health plan like deductibles and co.

For one self-employed individuals. Employees can elect up to the IRS limit and still receive the employer contribution in addition. 1 day agoTHE HSA.

Traditional Health Care FSA due to IRS regulations. Dependent-care Flexible Spending Accounts FSA let employees use tax-exempt funds to pay for childcare expenses they incur while at work. A health savings account HSA is a tax-advantaged account that individuals covered by a high-deductible health plan can use to help save and pay for qualified medical expenses.

A Conversation With Kelvin Wursten. Healthcare FSAs are a type of spending account offered by employers. In addition as part of COVID-19 relief the.

It can provide a grace period of up to 2 ½ extra months to use the money in your FSA. Health care FSAs and dependent care FSAs DCFSAs have annual contribution limits that you cant exceed during the year. Generally under these plans an employer allows its employees to set aside a certain amount of pre-tax wages to pay for medical care and dependent care expenses.

For 2022 you can contribute up to. Unlike a regular health FSA this employer. Instead you can participate in a Limited Purpose FSA.

Qualified health and dependent care expenses incurred from Jan. Joining Covenant Care is a great opportunity to advance your career and network with other health care professionals. Your employer can offer either one of these options but not both.

31 2022 will be eligible for reimbursement from your FSA accounts. The 2022 FSA contributions limit has been raised to 2850 for employee contributions compared to 2750 in 2021. Your employer may also choose to contribute.

If you have adopted a 570 rollover for the health care FSA in 2022 any amount. Like health care FSAs dependent care accounts are offered by employers to allow workers to set aside pretax money in this case to cover the expenses of caring for children or other family. For plan year 2022 in which the HCFSALEXHCFSA contribution limit is 2850 employees can carry over 20 percent of 2850 or 570 to the 2023 plan year.

As a result of COVID-19 participating employees are more likely to have unused health FSA amounts or dependent care assistance program amounts at the end of 2020 and 2021. FSAs only have one limit for individual and family health plan participation but if you and your spouse are lucky enough to each be offered an FSA at work you can each elect the maximum for a combined household set aside of 5700. If you provide health care FSA employer contributions this amount is in addition to the amount that employees can elect.

Ad Custom benefits solutions for your business needs. Obamacare Health Insurance Plans for 2022. You generally must use the money in an FSA within the plan year.

Dependent Care Flexible Spending Account FSA. These accounts are typically combined with a health savings account HSA to help families increase their healthcare savings during the year. Pre-tax dollars are put aside from your paycheck into your FSA.

This plan works the same as the Health Care FSA except you may not use this plan to pay for medical expenses. Elevate your health benefits. Easy implementation and comprehensive employee education available 247.

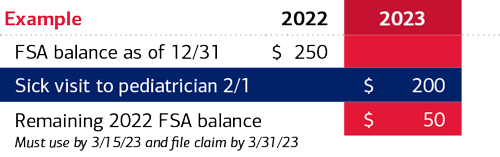

However you can still use any remaining 2022 funds from your health care andor dependent care funds to pay for qualified expenses until March 15 2023. For plan year 2021 the HCFSALEXHCFSA carryover limit to the 2022 plan year is equal to 20 percent of 2750 or 550 to the 2022. Dependent Care FSA Contribution Limits for 2022.

For 2022 the IRS caps employee contributions to 5000 for single filers and couples filing jointly and 2500 for married couples filing separately. Compare Coverage Shop All-New Plans. A limited-purpose flexible spending account LPFSA is a pretax account only available to employees enrolled in a qualified high-deductible healthcare plan HDHP.

How do they use these data sources. The IRS hasnt yet announced 2022 limits but your employer can tell you during open enrollment what limits they will be allowing. But your employer may offer one of 2 options.

If you have a dependent care FSA pay special attention to the limit change. And what kind of. Employees in 2022 can put up to 2850 into their health care flexible spending accounts health FSAs pretax through payroll deduction the IRS has announced.

The IRS sets dependent care FSA contribution limits for each year. With this account you can pay for dental and vision expenses only with pre-tax dollars. Serving a 23-county area our health system includes 10 hospitals outpatient clinics and physician offices and provides specialty services such as behavioral health cancer care home care and rehabilitation.

Later you can use this money to pay for qualified expenses such as medical care health-related products and other services. What is Ahcc Hpv. Choose Your Deductible Coverage Co-Pays and Get Customized Plan Recommendations.

The Navia Benefits Card will only load the amount contributed so far to your Day Care FSA. There are some qualifications to be eligible to take advantage of the full amount. Ad Find Obamacare Health Insurance Plans in Your Area.

Fsa Eligible Items And Expenses Of 2022 Best Ways To Use Your Fsa Dollars Cnn Underscored

Health Care Flexible Spending Accounts Human Resources University Of Michigan

Healthcare Fsa Vs Hsa Understanding The Differences Forbes Advisor

Fsa Carryover What It Is And What It Means For You Wex Inc

Understanding The Year End Spending Rules For Your Health Account

2022 Irs Hsa Fsa And 401 K Limits A Complete Guide

Understanding The Year End Spending Rules For Your Health Account

Health Cards Healthcare Hsa Fsa Or Hra Cards Visa

What Is An Fsa Definition Eligible Expenses More

What Is A Dependent Care Fsa Wex Inc

Flexible Spending Account Contribution Limits For 2022 Goodrx

Hra Vs Fsa See The Benefits Of Each Wex Inc

Healthcare Hsa Vs Fsa Understanding The Difference Alliance Health

2022 Irs Hsa Fsa And 401 K Limits A Complete Guide

Health Care And Limited Use Fsa Human Resources Northwestern University

Fsa Eligible Items And Expenses Of 2022 Best Ways To Use Your Fsa Dollars Cnn Underscored

What Is An Fsa Definition Eligible Expenses More